With an estimated 37% of the U.S. population having interacted with a financial institution’s AI chatbot in 2022, it’s no surprise that all of the top 10 banks in the country use this technology. These virtual assistant tools can act as low-touch solutions throughout the customer experience. But what happens when artificial intelligence is introduced to the financial services contact center, where customers may be more likely to expect a human agent?

The truth is that empathy is considered a crucial factor in all facets of customer service, and research is still undecided about when and how users empathize with AI technology. However, two-thirds of millennials expect real-time customer service — so the value of an AI system can’t be overlooked.

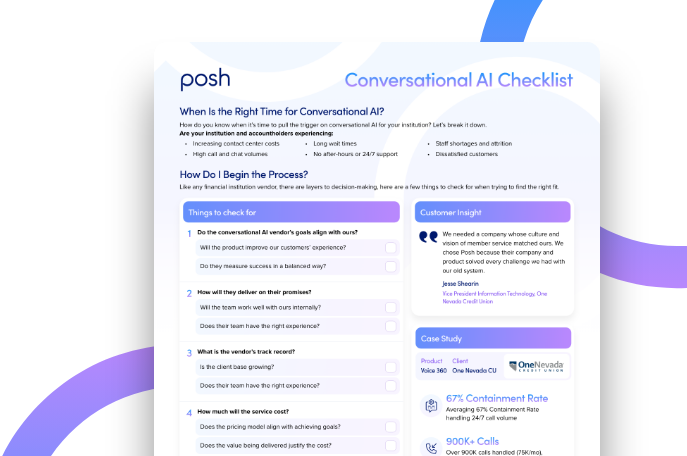

Call centers, therefore, must strike an appropriate balance between live agent support and AI software utilization. The key is finding the right AI call center solutions and leveraging them at effective intervals.

AI is Changing the Game for Call Center Operations

Traditional call centers have long faced limited resources and high demand. This is particularly true for 24/7 financial services contact centers, where agents often find themselves flooded with calls and requests. Without the resources, tools and workflows to support them, these agents can only do their best to juggle competing priorities — and too often, this leaves customers frustrated by long wait times and knowledge loss between calls or channel transfers.

That’s why many financial services institutions have turned their attention to AI call center software.

Of course, contact center AI is far from a new concept: Although the pandemic was a catalyst for many digital transformations across the financial services sector, AI was already a somewhat familiar idea. However, as generative AI, conversational AI and other tools become more commonplace in everyday life, customers and human agents alike have fast-growing expectations for quality assurance, accuracy, immediacy and more.

Call centers of all kinds have more than kept up. In a cross-industry survey where 20% of respondents were financial institutions, Deloitte found that 80% of contact centers are actively engaging in AI deployment. 17% have fully deployed an AI solution in all three top categories: agent assistance, virtual voice assistants and chatbots. Furthermore, 81% of respondents use voice/text analytics to improve customer service. 65% of these focus on customer insights and retention, risk identification and contact driver analysis; 40% focus on call quality assessment.

Although it’s clear that AI call center solutions come in many forms, some of the most significant progress is being made in these areas:

Empowering Live Agent Performance

Artificial intelligence scaffolds and supports human intelligence. AI solutions simplify tasks, streamline workflows, minimize manual effort and make accessing the right information at the right time easier. And it’s not just call centers or financial services institutions: Adobe research found that 92% of workers across all industries say AI technology has a positive impact, with 26% calling it a “miracle.” Top-reported benefits include saving time, completing tasks faster and reducing tedious work.

Enabling Self-Service

Self-service solutions put financial customers in charge of their own needs and experiences, allowing them to quickly address their needs without burdening your call center. AI only enhances these self-service opportunities, putting advanced functionality right at a customer’s fingertips on any channel.

For example, research from McKinsey indicates that, in some cases, the right AI technology can boost self-service utilization up to 3x. This came with a 20% reduction in cost-to-serve and a 40% reduction in service interactions.

Collecting Customer Data

Customer data represents a wealth of insights for any financial services call center, but gathering that data can be time-consuming and difficult. AI automatically turns every conversation, interaction and touchpoint into an opportunity to learn how your contact center is utilized and how it could be improved.

The Benefits of Using AI in Call Center Operations

No matter how you choose to leverage AI software, you can expect a variety of benefits and competitive advantages for your contact center. These include:

Delivering 24/7 Customer Service

Even when your human agents aren’t available, an AI-based call center can address customer needs and have intelligent conversations. That means your customers can perform banking tasks anytime, anywhere, making your financial services contact center a crucial part of their reliance on your brand and services. Plus, your live agents will have fewer urgent issues and competing priorities when they are available, making it easier for them to focus on delivering empathetic service for every customer issue.

Maximizing Operational Efficiency

Eliminate waste and streamline operations with smarter, faster, more efficient processes empowered by AI. You’ll quickly gain a competitive advantage over financial institutions that haven’t mastered the balance between AI and human support for customer inquiries, interactions and requests. You’ll also eliminate many of the costs and inefficiencies associated with traditional call centers — especially when it comes to limited staffing resources.

Creating a Seamless Experience

Omnichannel experiences are critical for financial customers, particularly members of digital-first generations. If knowledge is lost when a user switches between channels or if experiences are disjointed and disparate, the entire customer experience can suffer. Fortunately, AI makes it far easier for systems (and the agents that use them) to retain information across channels, even when escalating from artificial to live service. Additionally, the right AI software can help you make different channels feel unique while maintaining a sense of cohesion across all your institution’s digital offerings.

Streamlining Data Analysis

Every customer interaction can become a valuable insight if you have a system capable of turning data into actionable information. Of course, the right AI tool doesn’t just capture data; it offers analytic frameworks that enable you to extract relevant points based on context, goals, needs and more. For example, if chatbots frequently get questions about a particular service, you could learn:

- Whether your guidance, marketing or education around this service is underperforming.

- Which services are more popular than others.

- Which demographics are interested in a particular service.

- What a potential customer is looking for in this service.

Simplifying Lead Generation

Although lead generation can take many forms with AI tools, one of the most effective and low-touch solutions is to let your self-service tools do the work for you. If an existing customer asks one of several predetermined questions, you could automatically flag this account as a possible cross-sell or upsell opportunity or have it forwarded straight to a live agent through your contact center. The same is true for potential customers or first-time visitors: You can identify their intentions and respond with the most appropriate offer or service.

Reducing Overhead

The traditional call center may be expensive to operate, but it can’t be entirely eliminated. AI solutions allow you to keep what works and improve what doesn’t — particularly when it comes to operational costs. For example, research has shown that the estimated savings for banks using AI have grown from $209 million in 2019 to $7.3 billion in 2023.

Top AI Solutions for Contact Centers

Every financial institution has unique needs in its contact center. That’s why the ideal AI solutions must be flexible, intuitive and effective. Here are three examples:

Interactive Voice Response

An AI Voice Assistant enhances contact center operations with automatic speech recognition, leveraging conversational AI technology to respond intelligently and effortlessly. 24/7 availability and seamless call routing help support your live agent team when necessary — all while delivering exceptional experiences to callers and saving relevant customer data. Your company could handle millions of calls without a live agent, reducing the cost of overflow calls by 63%, speed-to-answer by 92% and abandon rates by 93%.

Intelligent Virtual Agents

With Digital Assistant, a conversational AI chatbot, customers can handle self-service needs from basic questions to more involved financial tasks. You can customize these interactions to meet specific needs or deliver unique outcomes — and if a customer needs more help, Digital Assistant can reroute the conversation to a live agent with full context and a complete transcript. That means you could handle 100% of after-hours chats and save thousands of dollars and hours.

Knowledge Assistants

Give your live agents the support they need with Knowledge Assistant. This conversational interface delivers immediate answers to agent queries, cutting search time by 93% and improving employee productivity and satisfaction in your call center. Plus, Knowledge Assistant can help gather insights on searches, query effectiveness, bot accuracy and more, delivering the data you need to constantly improve your processes.

Discover What AI Can Do For Your Call Center

With many employees and customers expecting AI at every turn, your financial institution can’t afford to fall behind. Fortunately, a variety of AI solutions are available to address your needs, deliver top-notch experiences and optimize your call center operations.

Posh’s AI offerings — plus our experience supporting banks and credit unions — make us the perfect partner for your digital transformation efforts. We’re here to help your agents (and your financial customers) do more.

Request a demo today to experience Posh.

Blogs recommended for you

February 12, 2024

How AI Helps You Improve Contact Center Agent Satisfaction

Read More

How AI Helps You Improve Contact Center Agent Satisfaction

February 2, 2024

Implementing AI during Your Telephony Move to the Cloud

Read More

Implementing AI during Your Telephony Move to the Cloud

Event -

Harness the Power of AI for Call Centers

Are you attending and interested in learning more?

Register today

Visit event page to learn moreEmail info@posh.ai for the recording!

December 29, 2023

6:26 pm

Virtual event

Event Details

Speakers

No items found.

.png)