Meet Eric Money, Regional Sales Manager, as we walk through his unique banking and credit union experience and how that led him to selling the products he needed the most.

Tell us about your background and experience

After I graduated from university, I spent the first 6 years of my career in banking. I first worked as a teller, banker and service branch manager at one of the largest national banks, then went to a small community credit union working in the corporate contact center as a senior outbound loan officer. I was in outbound sales, calling our customers, educating them on other financial products we offer, helping with refinance, mortgage loans, and more.

I truly got the best of both worlds, experiencing the differences between how a large bank and a small community credit union both operate.

What brought you to Posh?

After my years in the banking industry, I found myself at a software company. Here I was responsible for sales, implementation and configuration, API set up, collaboration with development, training clients, and the primary account manager for my accounts. Posh perfectly married my experience in the banking world, with my experience in software. It was a no brainer to join.

What were some of the challenges you faced while working in the banking industry?

The biggest challenges were 1) finding answers to customer questions efficiently 2) the inconsistency in answers 3) the length of ramp up time to feel fully up to speed.

While at the CU, I worked with the outbound team to drive business growth. When the inbound department faced an influx of calls, we were often redirected to help reduce the queue, diverting our attention from sales efforts.

Transitioning from outbound to inbound, I’d have to re-familiarize myself with some of the key questions customers asked like “How do I send a wire” to “How can I open a new account”. Since I wasn’t actively answering these questions everyday, I’d have to search through all of our documentation and procedures to answer customer questions, or ask my peers or manager effectively pulling them from their customer interactions. This led to long handle times, and sometimes even required hanging up on a customer, removing myself from the queue to then go find an answer.

Because procedures changed so often, my first course of action was asking coworkers around me for the answer. Answers were also up to our interpretation. We didn’t have a consolidated source of truth for knowledge, so there would be inconsistencies in the ways each agent responded to customer questions.

The training period at the CU was long, half of it focused on policies, procedures, and the other half focused on shadowing current agents. With how often agents come and go, the training is constant and continuous shadowing and answering new agent questions takes away valuable time from customers.

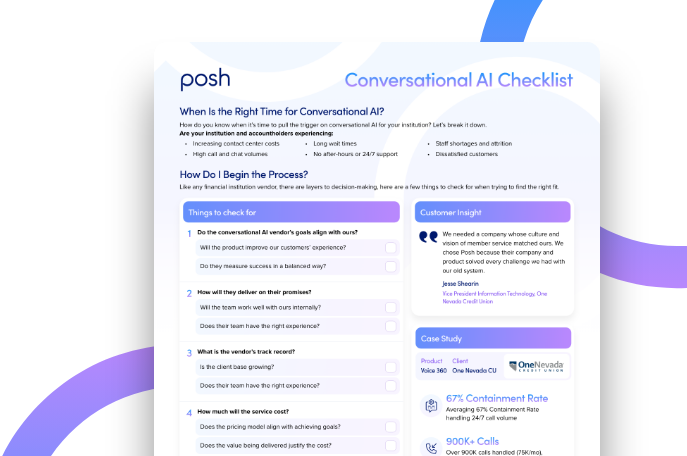

How do the Posh products provide solutions to the challenges you used to face?

As a contact center agent, you are the first line of defense. Whether it's through phone calls or digital channels, we are the first ones that interact with a customer. If the line is busy, the customer gets told they have to wait and will immediately be frustrated. With our Voice AI Solution, it can answer thousands of calls at the same time. It gives customers the ability to self service and get their questions answered instantly.

When a customer does interact with a live agent, if needed, agents need to be able to answer their questions efficiently and consistently. Knowledge Assistant provides agents the ability to quickly access consolidated information. It helps reduce handle time, facilitates quick onboarding of new staff and leads to a better customer experience.

Any product that relieves pressure on agents is huge. The role is high stress, and typically lower wages which leads to a high turnover rate for contact center agents. Plus it's increasingly difficult to find new staff. The Posh products all help to take the pressure off agents, allowing them to dive into the more complex customer issues. Happy agents = happy customers!

Call centers also want to be able to control the messaging when unexpected situations arise. For example, stimulus checks, tax season, and so on - lots of very specific questions get asked. They want to be able to control how we discuss each of these, at certain times. With Posh, this can be done immediately within Posh Portal. The changes take effect instantaneously, and the message can change anytime.

How do you feel about the role of AI within the financial industry?

AI is the next wave of technology that can make or break a company. The pandemic has taught us we have the leverage technology to work smarter, not harder. In the 70s when ATMs were introduced, people thought “why would we need these when we have tellers”? Now, we can’t see ourselves without ATMs. In the 90s when internet and mobile banking became a thing, people said “why do we need this, we have ATMs”. Now, we can’t see ourselves in a world without any of these. Everything is becoming more mobile, more electronic and people are becoming more self resourceful. If you’re not on board in the next few years, you’ll be left behind.

What makes Posh special?

Being an AI native company, not just an add on that's specifically designed to this financial institution space shows we are so dedicated to being and remaining the best of breed AI solution for banks and credit unions. This really sets us apart that we are dedicated and committed to this space.

We really do an incredible job at guiding our clients along. We collaborate and partner from our very first encounter with them. We provide exceptional service, we don’t just sell. When I’m “selling” something, I’m much more about educating our clients, providing guardrails and keeping you on the path to success. I want to provide them with all the tools and information they need so they can make an educated, well informed decision. I want our customers to feel empowered and confident and bought in. We are transparent, we share the pros and cons of everything. Posh won’t ever be 100% perfect, 100% of the time, but we will always make things right. Software is ever changing and we are committed to making it right and working with every customer to make it successful.

Blogs recommended for you

.png)

December 22, 2023

5 Biggest AI Trends for Banking in 2024

Read More

5 Biggest AI Trends for Banking in 2024

January 26, 2024

AI Customer Service Solutions: Elevating the User Experience

Read More

AI Customer Service Solutions: Elevating the User Experience

Event -

From Frontline Worker to Posh Sales Team

Are you attending and interested in learning more?

Register today

Visit event page to learn moreEmail info@posh.ai for the recording!

September 5, 2023

4:34 pm

Virtual event

Event Details

Speakers

No items found.