Hudson Valley Client Story

Established in 1963, Hudson Valley Credit Union (HVCU - $7 billion AUM) serves 12 counties in New York State. Their mission is to create successful futures for their members, staff, and communities, one relationship at a time. With a vision to create financial security and a better quality of life, HVCU staff live their core values every day to focus on the unique needs, problems, and challenges their members face.

Hudson Valley Credit Union began reexamining member experience when they observed their Live Chat interaction volume increasing faster than they could hire and train new agents to their high standards. HVCU identified that many interactions consisting of repetitive questions could be answered with publicly available information on their website. Conversational AI was an opportunity to ease the volume of requests and allow agents to apply their skills in sales, empathy, and relationship building.

“The number of [high volume] repetitive interactions was an issue. We wanted to enable our members to have answers immediately without requiring live agent support thereby providing friction-free service,” said Steve Goodwine, Assistant Vice President of the Contact Center at Hudson Valley Credit Union.

Partner Considerations

Hudson Valley was exploring Conversational AI providers over multiple years, building the necessary organizational buy-in to proceed. The team focused on finding a solution that allowed their members to ask questions and receive immediate answers.

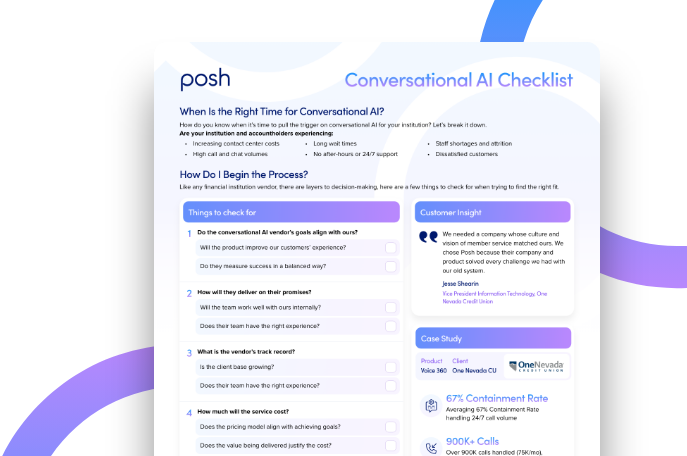

Hudson Valley's list of partner criteria included:

- A best-in-class experience for credit union members

- Off-the-shelf ready with default intents for an immediate time to value

- Easy to implement

- Complete AI offerings including digital and voice capabilities

- Technology that was built for easy integrations into existing systems

- Easy to use for members, improving the current member experience

Hudson Valley Chooses Posh

During the partner selection, other vendors were considered along with Posh. Competing AI providers offered many “bells and whistles,” which sounded great at the beginning; however, after internal review these features created more complexity without elevating the member experience. Those features were not banking-focused.

“[The product] would have been so much more complicated to implement and maintain. We are not seeing anyone asking for some of the features being offering. It would have been a lot of work with very little value,” Goodwine said.

Hudson Valley chose Posh, implementing the Digital Assistant for the ease of use, as well as the default intents, a focus and commitment to credit union needs, and voice capabilities for the future. Posh’s intent to integrate with the growing ecosystem of other solutions for CUs was also a big plus.

Implementing Lee, The Digital Assistant

Posh worked closely with Hudson Valley and its partners, including the live chat vendor and the online banking provider to deploy Lee within HVCU’s website. The ability to add or edit Lee’s responses was a key win for the team.

“Accessing technology in this space that doesn’t require a programmer to effectively use it and serve members is huge,” noted Goodwine. “We can shift so rapidly. If we send out a communication, five minutes later our assistant can answer questions about it. We don’t need to put in an IT ticket and wait for a programmer; we can quickly and easily put in the information ourselves.”

After some team discussion, HVCU named their assistant Lee. The team researched AI deployments and found a few similarities in the most successfully named bots, including never trying to hide that it was a bot. They curated interactions as human-like as they could. “Having a name for our ‘digital employee’ was part of making that interaction more human-like while acknowledging the advances technology can provide,” Goodwine said.

Lee Today

Lee continues to see significant increases in usage, from both members and non-members. At the same time Hudson Valley continues to see this channel grow, the need to add resources has stayed flat. They are able to handle more with less, providing members with information 24/7.

“Agents are [feeling] happy chatbots are taking on interactions that require no skills. Our agents now enjoy more engaging conversations with members that go deeper,” Goodwine said. “They’re using their skills and are more engaged, so our agents are more satisfied with the work they’re doing. Happy staff make happy members”

Boosting Efficiency & Accuracy, Taking the Pressure off Agents

The addition of Knowledge Assistant empowers call center agents with quick and efficient access to information leading to time savings per call, additional calls able to be handled, and headcount savings. HCVU deployed Generative AI Powered Knowledge Assistant in summer 2023, and have seen tremendous savings since the launch including a 201% ROI and $163K in annual savings.

“Knowledge Assistant allows our agents to ask a question and get the answer immediately,” says Goodwine. “There are no more bottlenecks, agents no longer need to ask peers or make a guess. It's no longer a scavenger hunt through 5,000 documents. The knowledge is now unlocked, it's right at their fingertips. We are increasing the accuracy and efficiency of responses, leading to a higher first call resolution.”

Goodwine also noted, “With Knowledge Assistant, the pressure is taken off employees. You don't create situations where members get impatient waiting for an answer. It's a lot less stressful, our agents are expected to know everything off the top of their head. They just need to know how to ask a question.”

HVCU is also excited to launch the Posh Voice Assistant sometime this year. We want our members who want to talk to our agents to get right through and those who have other questions to be easily self-serviced and answered right away.

“The experience has been better than anticipated. The system is incredibly easy to use. Without having to hire additional people, we serve our members faster and at all hours,” Goodwine said. “Our self-service solutions have been more successful as our members now have a guide to take them step-by-step through what they want to do.”

Blogs recommended for you

December 5, 2023

How Posh Secures Critical Documentation in Knowledge Assistant

Read More

How Posh Secures Critical Documentation in Knowledge Assistant

May 23, 2023

Transforming Member Experience: A Credit Union's Success with Conversational AI

Read More

Transforming Member Experience: A Credit Union's Success with Conversational AI

February 4, 2024

4 Tips for Successful Change Management in AI Implementation

Read More

4 Tips for Successful Change Management in AI Implementation

Event -

Client Story: Hudson Valley Credit Union

Are you attending and interested in learning more?

Register today

Visit event page to learn moreEmail info@posh.ai for the recording!

February 7, 2023

6:58 pm

Virtual event

Event Details

Speakers

No items found.