When Is the Right Time for Conversational AI?

What if I told you the solution to many of your call center pain points—increasing costs, staff shortages, increasing wait time, after-hours support, and dissatisfied customers—could be addressed with conversational AI?

Traditionally, artificial intelligence has been, well, less than intelligent when handling financial conversations. Customers and members have a poor perception of chatbots for a reason: Most automated conversational tools fail to recognize nuance, which leads to frustration. Not all bots are created equal.

Open Doors for Self-Serving Customers

So how do you know when it’s time to pull the trigger on conversational AI for your institution? Let’s break it down.

Are your institution and accountholders experiencing:

- Increasing contact center costs

- High call and chat volumes

- Staff shortages and attrition

- Long wait times

- No after-hours or 24/7 support

- Dissatisfied customers

If you’re struggling with these challenges, you’re not alone—and conversational AI can help you find real solutions.

The addition of conversational AI can provide the benefit of customers supporting themselves, retrieving answers instantly, as well as being escalated to an agent when needed.

How Does Conversational AI Work for Banking?

For the end-user, conversational AI is like speaking with a digital assistant like Siri, Google Assistant, or Amazon Alexa. Digital voice assistants listen, learn and deliver the information you need.

Posh’s conversational AI grew from the same roots as mainstream digital assistants like Siri. Co-founders Karan Kashyap (CEO) and Matt McEachern (CTO) were graduate students working on AI at MIT’s artificial intelligence lab, and Posh shares the same concept of simple, intuitive functionality, built specifically into a proprietary tool designed for banking.

If your customers ask a question like what is your routing number?, Posh’s bots can provide answers quickly and consistently without becoming confused about banking colloquialisms, banking-specific terms, or institution-specific questions—all while maintaining your brand identity.

Learn more about the Platform.

Does AI Help Customer Service Pain Points in Banking?

Conversational AI is the first line of defense when it comes to customer service. AI can do a lot of heavy lifting for an affordable price.

When a customer calls or engages with your website or online and mobile banking, they’re interested in answers or action. With an AI assistant, you’re able to provide your customers with both.

View our products and services.

Lowering contact center costs.

Contact centers are a costly but necessary budgetary item. With AI acting as an intermediary, questions that don’t need to be escalated are contained and don’t make it to the overflow or contact center. Posh clients have seen as much as $100k savings per month.

Addressing staff shortages and attrition.

It’s important to maintain staff. Without having to train or hire anyone new, AI acts as another employee, handling many of the tasks that fuel churn in your call center. Posh’s tool answers calls, addresses questions, and much more. Relieve pressure on your staff and focus more on customer success.

Conversational AI leverages the power of multiple people working together, answering the phone, and hosting a transaction without disrupting your personnel budget. Something to keep in mind is the analytics provided through AI. AI analytics help FIs understand the why. Why are people calling? Why are customers frustrated?

Decreasing call wait time for customers.

The pandemic really changed the game. More people than ever are choosing to bank from home—and as a result, customer service demand and wait times have drastically increased. Fear not: AI is here to help your customers feel supported and cared for. The proper AI tools manage customer question difficulty (from easy to escalation) to improve wait times and assist more people.

Providing after-hours support.

Businesses close for the evening—that’s pretty normal. The issue is that your customers expect 24/7 service. When that isn’t a feasible option, conversational AI brings customer service to 24/7 availability.

Enhancing customer satisfaction.

You will never please 100% of your customers, but you can ease their minds with a dramatically quicker and more efficient customer service tool. Digital assistants can always answer the phone or chat with speed, accuracy, and warmness while maintaining your brand.

It’s important to keep in mind consumers expect convenient, 24/7 experiences similar to the service they receive from Amazon or Uber. The customers aren’t comparing one FI experience to another FI experience, they're comparing their FI customer experience to their most recent customer experience (at Starbucks, Amazon, Uber, etc).

With that said, let’s be abundantly clear: AI is not a replacement for humans. Your people are what makes your customer service so great. Your customers rely on familiar human faces to provide them with regular assistance. The bot is there to pick up the heavy call volumes or answer routine questions that take time away from more pressing customer issues.

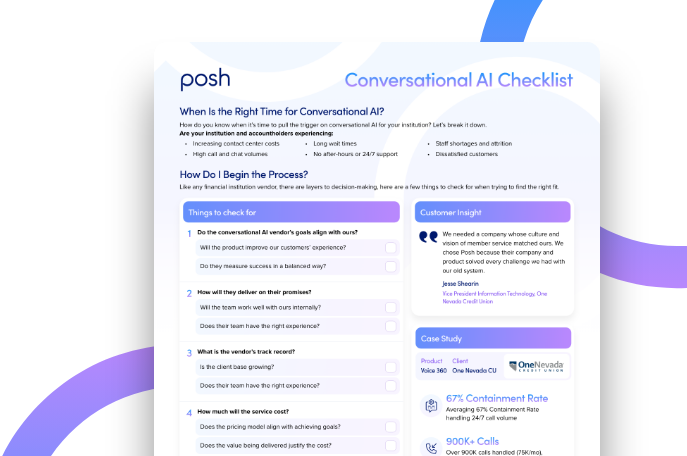

How Do I Begin the Decision Process?

Like any financial institution vendor, there are layers to decision-making, here are a few we think you should consider when trying to find the right fit.

Do the conversational AI vendor’s goals align with ours? It’s important to decipher intentions. Do they want to improve our customer experience, or simply grow their revenue? How does the vendor measure success? Is it just containment? Don’t rely on vendors who flaunt containment or make that a major driver in their pricing model. Containment isn’t the metric to guarantee a successful customer experience. An annoyed customer hanging up or exiting a chat, though contained, doesn’t mean the AI delivered a helpful banking experience. Similarly, a vendor can theoretically achieve very high containment by purposely making it difficult for the caller to get the agent help they might really need. The determination of a helpful experience is multilayered, and your vendor should understand that.

How will they deliver on their promises? Do your homework on the product, team, and working style. Do their product channels support your needs? Who is on the team and do they have the right experience? How does the team operate, and do they understand the internal needs of our teams?

What is the vendor’s track record? Consider their client base, is it growing? Are their clients going live with any regularity? Do they have supportive investors and have they been able to raise money? For more insight, we recommend checking their website, reaching out to clients, and even looking at sites like Glassdoor.

How much will the service cost? Does the value being delivered justify the cost? Does the pricing model align with achieving goals, both for the FI and the end user?

Ensure the vendor is “technically sound.” Do the vendors support your compliance needs?

This can be tricky depending on the availability of technical roles on your team. We recommend:

- Validate the vendor’s data transparency. (It’s important to access the analytics on demand to audit the bot's success)

- Are they willing to share a SOC-2 Type 2 report to prove they handle your data safely?

Why Trust Posh for Better Banking Customer Service?

Empathy. Posh understands your pain points. Our team is working with more than 50 clients across the financial institution industry, listening to why it’s important to care for customers. We learn what’s most important to you, which allows our tools to operate more efficiently and accurately than off-the-shelf chat solutions.

Quality. Our technology was built specifically for banking. We don’t serve any other professional verticals. We employ veterans of the credit union and banking industry to better serve you, our clients, and—most importantly—your customers.

Transparency. We believe that data is the ultimate driving force of change and success. Without your data, you can’t change course, be attuned with your customers, or identify your pain points. Posh provides full access to all chat logs, busiest times, and much more.

Don’t be shy. See our bots in action today! Request a personalized demo today!

Blogs recommended for you

.png)

December 29, 2023

Harness the Power of AI for Call Centers

Read More

Harness the Power of AI for Call Centers

February 12, 2024

How AI Helps You Improve Contact Center Agent Satisfaction

Read More

How AI Helps You Improve Contact Center Agent Satisfaction

Event -

When Is the Right Time for Conversational AI?

Are you attending and interested in learning more?

Register today

Visit event page to learn moreEmail info@posh.ai for the recording!

June 16, 2022

2:45 pm

Virtual event

Event Details

Speakers

No items found.

.png)